straight life annuity definition

The straight-line method is the simplest and most commonly used way to calculate. There are many options out there.

What Is A Straight Life Annuity Everything You Need To Know

Forethought Choice Income annuity is a 10-year fixed indexed annuity designed for earning interest based on the performance of a stock market index locking in any gains while protecting the investment against stock market losses deferring taxes until future withdrawals and creating a guaranteed income for life.

. This benefit stream is actuarially equivalent to a straight life annuity at age 70 of 260606 an amount greater than the section 415 limit determined at the original annuity starting date using the interest and mortality rates applicable to such date. With a life insurance policy written in trust the proceeds of the policy can be paid directly to your intended beneficiaries rather than to your legal estate. A 25 depreciation for plant and machinery is available on accelerated depreciation basis Accelerated Depreciation Basis Accelerated depreciation is a way of depreciating assets at a faster rate than the straight-line method resulting in higher depreciation expenses in the early years of the assets useful life than in the later years.

Thus the lump sum payment to D fails to satisfy the condition under paragraph c3 of. The reserve study consists of two parts. Chapter 1 Overview to describe Definition Specifications and Classification of Straight Life Insurance market Applications Agency Brokers Bancassurance Digital and Direct Channels Market.

Businesses can recover the cost of an eligible asset by writing off the expense over the course of its useful life. Chapter 1 Overview to describe Definition Specifications and Classification of Child Life Insurance market Applications Below 10 Years Old 1018 Years Old Market Segment by Types Term. A joint life insurance policy covers both partners but pays out only once in the event of a valid terminal illness or death claim.

The assumption that assets are more. A reserve study is a long-term capital budget planning tool which identifies the current status of the reserve fund and a stable and equitable funding plan to offset ongoing deterioration resulting in sufficient funds when those anticipated major common area expenditures actually occur. Joint life insurance in trust.

Being a Non-Residential Indian and Overseas Citizen of India you can have a secured life in India with peace. You can confirm with the insurer what other documents may be required. Several insurance companies may classify peoples life by fixing the premium and coverage amount.

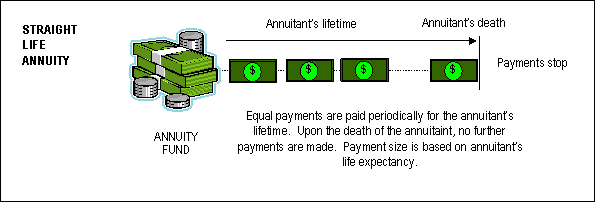

The physical analysis and the financial analysis. Annuity holders will pay fees up-front and sacrifice potential returns possibly earned elsewhere but in return an annuity provides certain guarantees and safety nets such as guaranteed income.

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

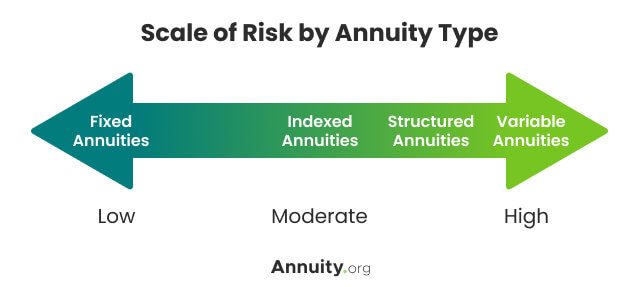

Types Of Annuities Understanding The Different Categories

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Straight Life Annuity Everything You Need To Know

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download

Life Insurance Vs Annuities Which Is Best For You

Straight Life Annuity Providing Peace Of Mind In Your Retirement

Period Certain Annuity What It Is Benefits And Drawbacks

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

What Is A Straight Life Annuity Everything You Need To Know

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Straight Life Annuity Definition

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation